Discover 7422 Tools

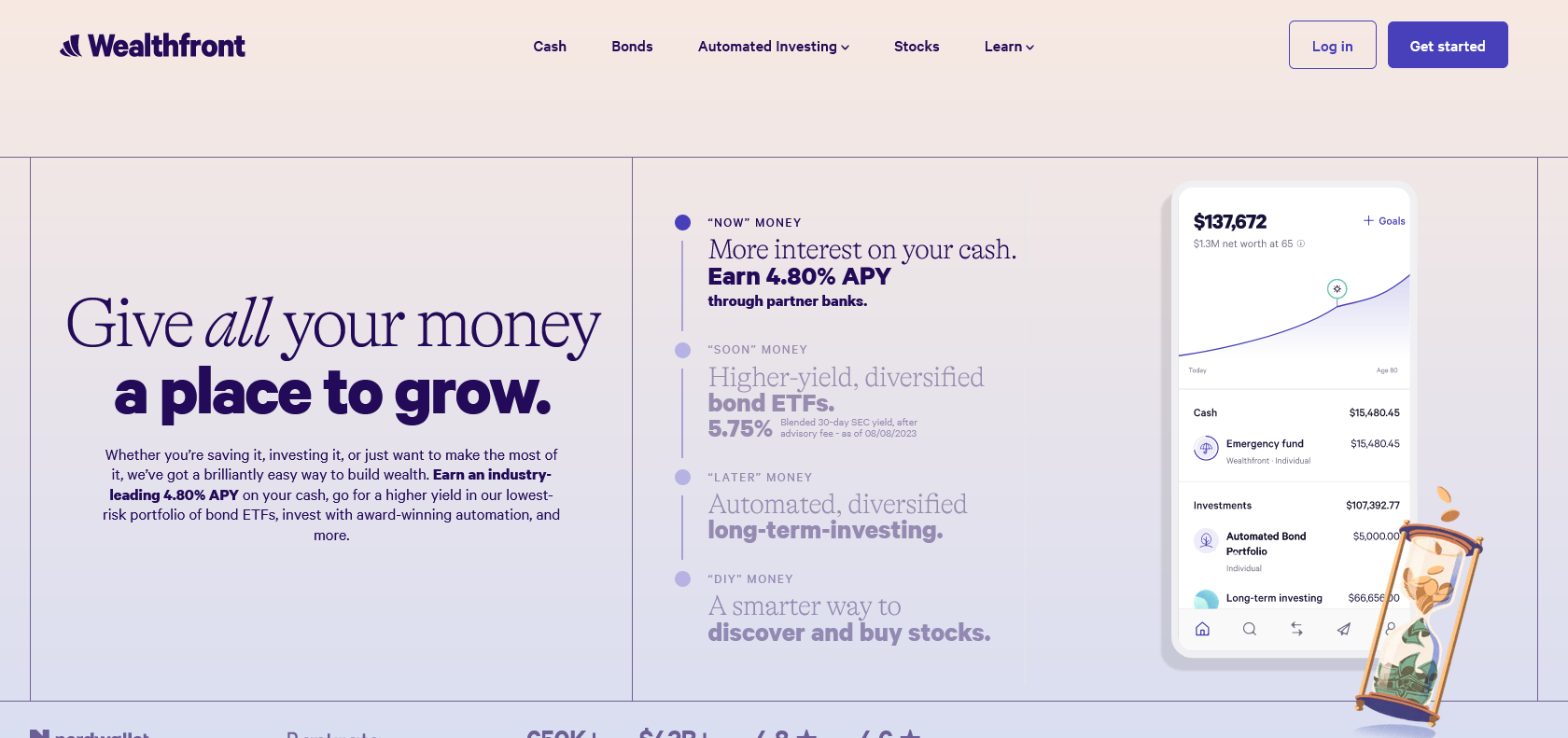

Make smart decisions with automated investing.

Discover the benefits of Wealthfront - an automated investing service offering comprehensive financial planning, portfolio management, and personalized advice.

Wealthfront is an automated investing service that offers a range of features to help individuals effectively manage their finances. One key feature is its ability to automatically rebalance portfolios, ensuring that investments stay aligned with your goals. This takes the hassle out of monitoring and adjusting your portfolio manually.

With Wealthfront, users also have access to intuitive tools that aid in making informed decisions about their money. Whether it's understanding risk tolerance or assessing investment opportunities, the service provides personalized guidance to help you make the right choices.

One of the standout advantages of Wealthfront is its low-cost, automated approach to investing. By utilizing technology and data-driven strategies, the service is able to offer a cost-effective solution for individuals looking to grow their wealth.

In addition to its investment management features, Wealthfront offers real-time market data and various tax-advantaged investment strategies. This makes it a comprehensive service for those who want to save and invest for their future.

Receive personalized advice for better investment choices.

Wealthfront

Join the AI revolution and explore the world of artificial intelligence. Stay connected with us.

Copyright © 2025 AI-ARCHIVE

Today Listed Tools 174

Discover 7422 Tools