Discover 7422 Tools

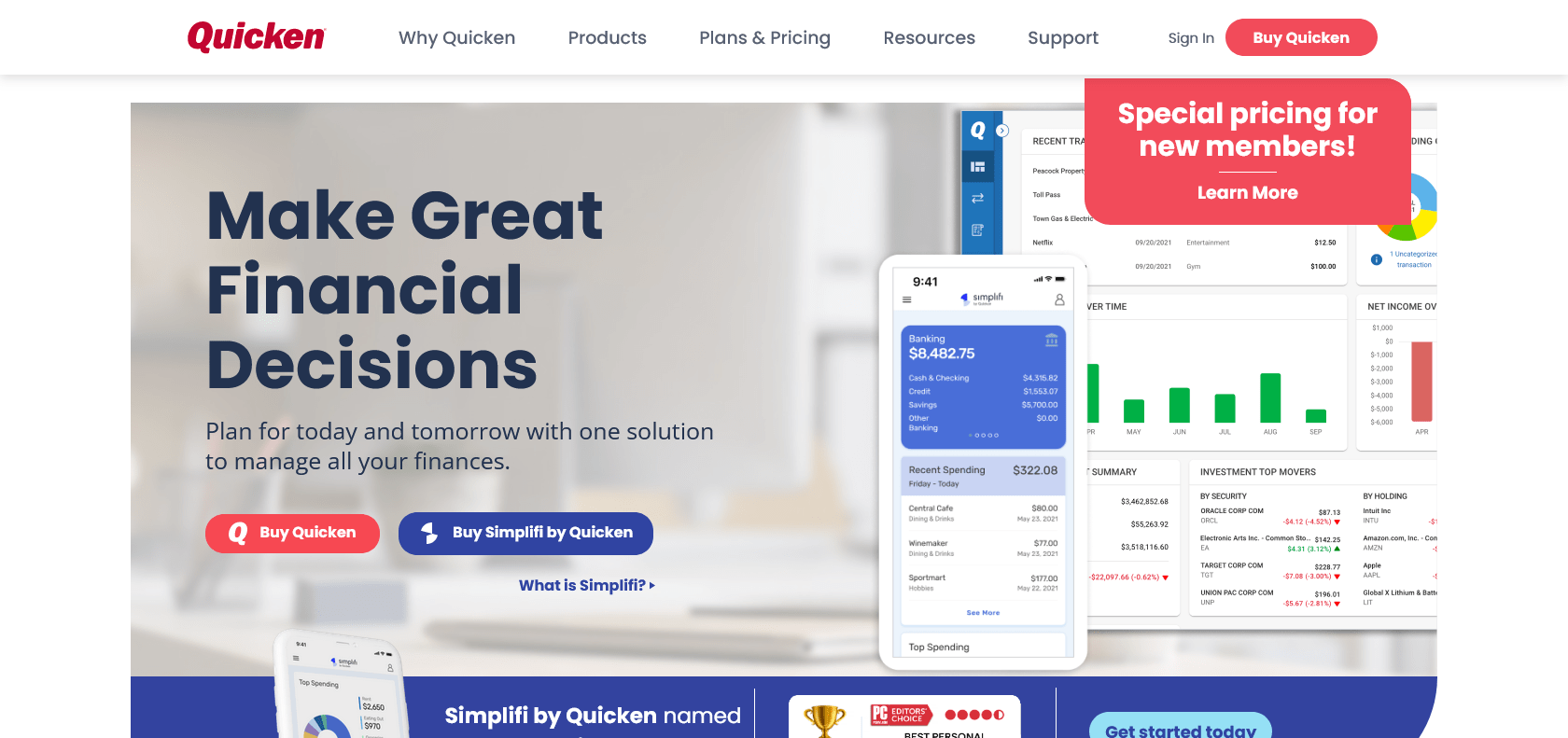

Manage Your Finances with Quicken.

Track spending, income, and balances. Set up automatic payments. View credit score and investments with Quicken, the comprehensive financial management tool.

Quicken is a powerful financial management tool that provides a wide range of features to help you take control of your finances. One of its key features is the ability to track your spending, income, and account balances all in one place. This makes it easy to see exactly where your money is going and helps you make informed decisions about your finances.

Another useful feature of Quicken is the ability to set up automatic payments. This means you can schedule your bills and other regular payments to be paid automatically, so you never have to worry about missing a payment again. This not only saves you time and effort, but it also helps you avoid late fees or penalties.

In addition to managing your day-to-day finances, Quicken also allows you to view your credit score and track your investments. This is particularly useful for those who are interested in monitoring their financial health and making informed investment decisions.

One of the advantages of Quicken is its accessibility. You can access your financial data from any device, whether it's your computer, tablet, or smartphone. This means you can always stay connected and in control of your finances, no matter where you are.

Lastly, Quicken offers a secure online storage option for your financial data. This ensures that your information is protected and gives you peace of mind knowing that your sensitive financial information is safe.

Track spending, income & balances

Set up automatic payments

View credit score & investments

Quicken

Join the AI revolution and explore the world of artificial intelligence. Stay connected with us.

Copyright © 2025 AI-ARCHIVE

Today Listed Tools 213

Discover 7422 Tools