Discover 7422 Tools

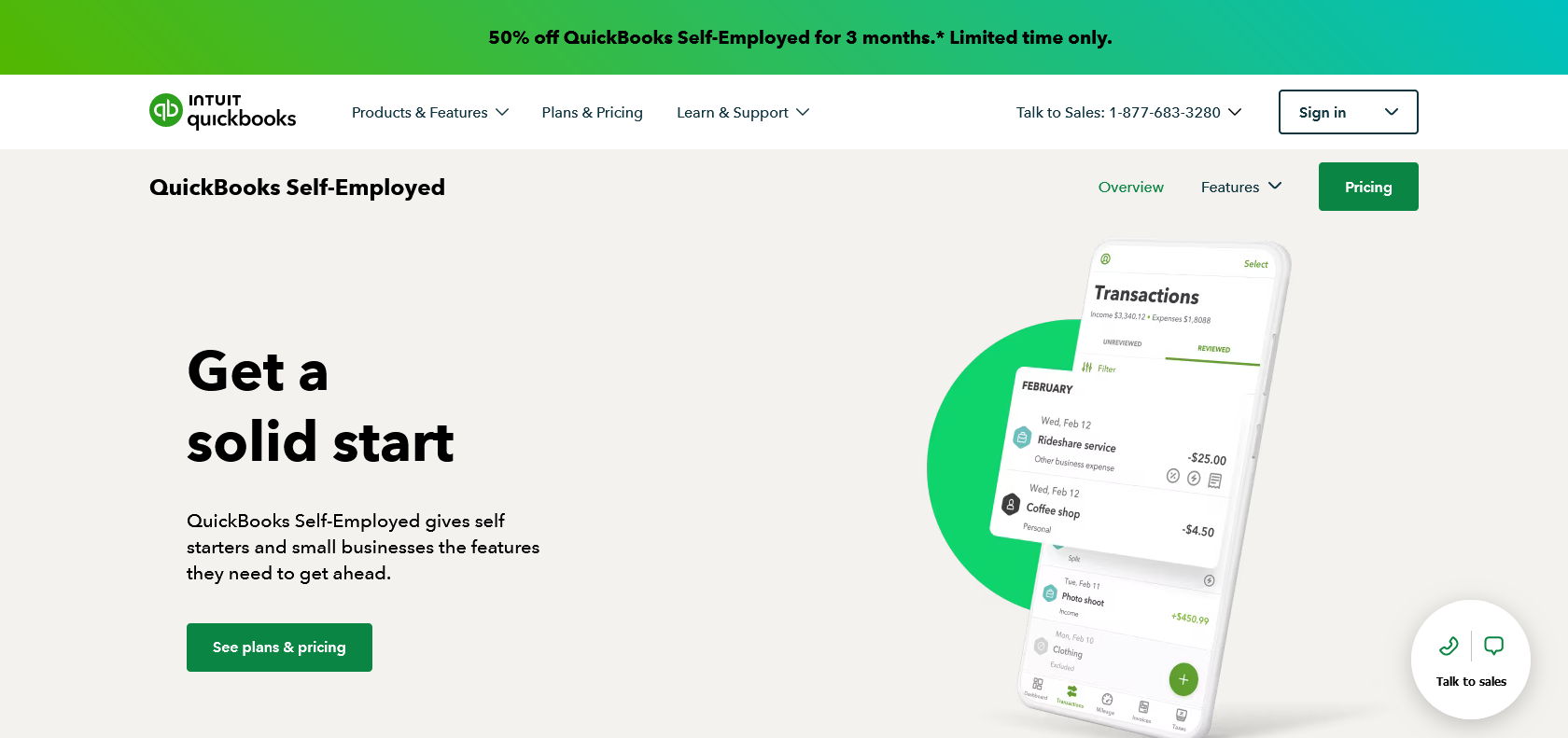

Maximize income with QuickBooks Self-Employed.

Maximize income and stay organized with QuickBooks Self-Employed: track income & expenses, generate tax reports, and access data securely.

QuickBooks Self-Employed is a reliable and efficient solution for freelancers and independent contractors. It offers a range of features that make it easy to track income and expenses, file taxes, and manage finances effectively. The user-friendly dashboard and mobile app ensure convenient access to financial data on the go.

One standout feature of QuickBooks Self-Employed is its ability to automatically track income and expenses. This saves users time and effort by eliminating the need for manual input. The service can also identify and categorize expenses automatically, making it even easier to stay organized.

Another valuable feature is the ability to generate detailed reports for tax deductions. QuickBooks Self-Employed provides users with comprehensive reports that break down expenses, making it simple to claim deductions and maximize income.

Security is a top priority with QuickBooks Self-Employed. The service includes a secure and reliable cloud storage system, allowing users to store their financial data and access it anytime, anywhere. This ensures the safety of sensitive information, giving users peace of mind.

User-friendly dashboard and intuitive mobile app.

QuickBooks Self-Employed

Join the AI revolution and explore the world of artificial intelligence. Stay connected with us.

Copyright © 2025 AI-ARCHIVE

Today Listed Tools 490

Discover 7422 Tools