Discover 7422 Tools

Stay informed and confident about taxes.

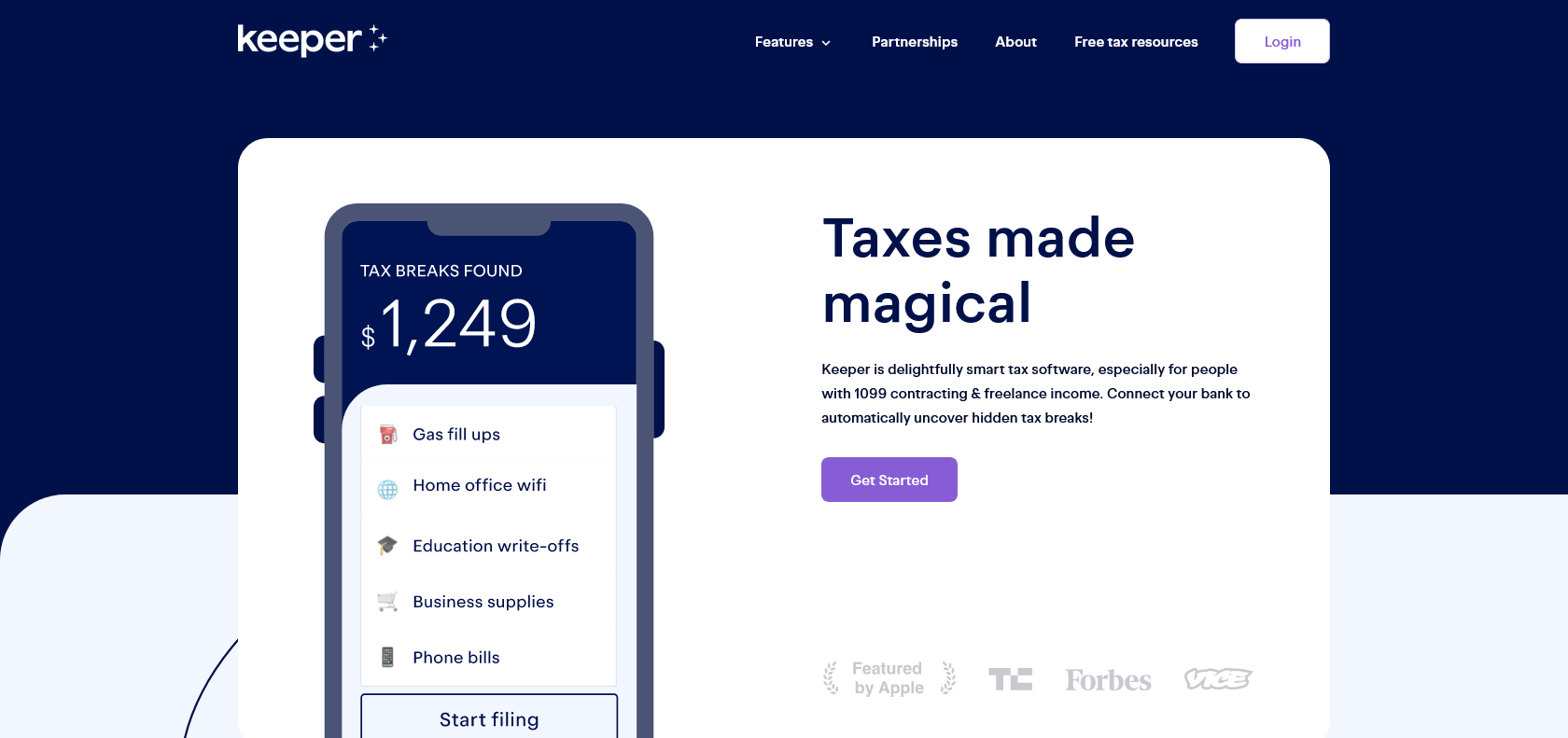

Keepertax offers accurate & up-to-date information on US tax law, AI-powered answers to tax queries, & human tax pro reviews for added reliability.

Keepertax Ask an AI Accountant is an impressive tool that is designed to make navigating the complexities of the US tax system a breeze. This free resource uses AI technology to provide accurate and up-to-date information on US tax law. By simply asking a question related to taxes, you can receive an answer that is trained on the latest tax changes for 2023.

One of the standout features of Keepertax is that every answer provided by the AI is reviewed by a human tax professional. This ensures that the information you receive is not only reliable but also tailored to your specific needs. The human professional also provides relevant comments, further enhancing the accuracy and usefulness of the response.

With Keepertax Ask an AI Accountant, you can stay informed and ensure that you are paying the right amount of taxes. No more guessing or sifting through complicated tax documentation. This tool streamlines the process by providing the answers you need quickly and accurately.

So, if you want to take the hassle out of dealing with the tax system and stay on top of the ever-changing tax laws, Keepertax Ask an AI Accountant is the tool you need. Start using it today and experience the convenience and accuracy it offers.

Accurate, up-to-date information on US tax law

Ability to ask questions about taxes and receive answers

Review and comments from a human tax professional

Keepertax

Join the AI revolution and explore the world of artificial intelligence. Stay connected with us.

Copyright © 2025 AI-ARCHIVE

Today Listed Tools 271

Discover 7422 Tools