Discover 7422 Tools

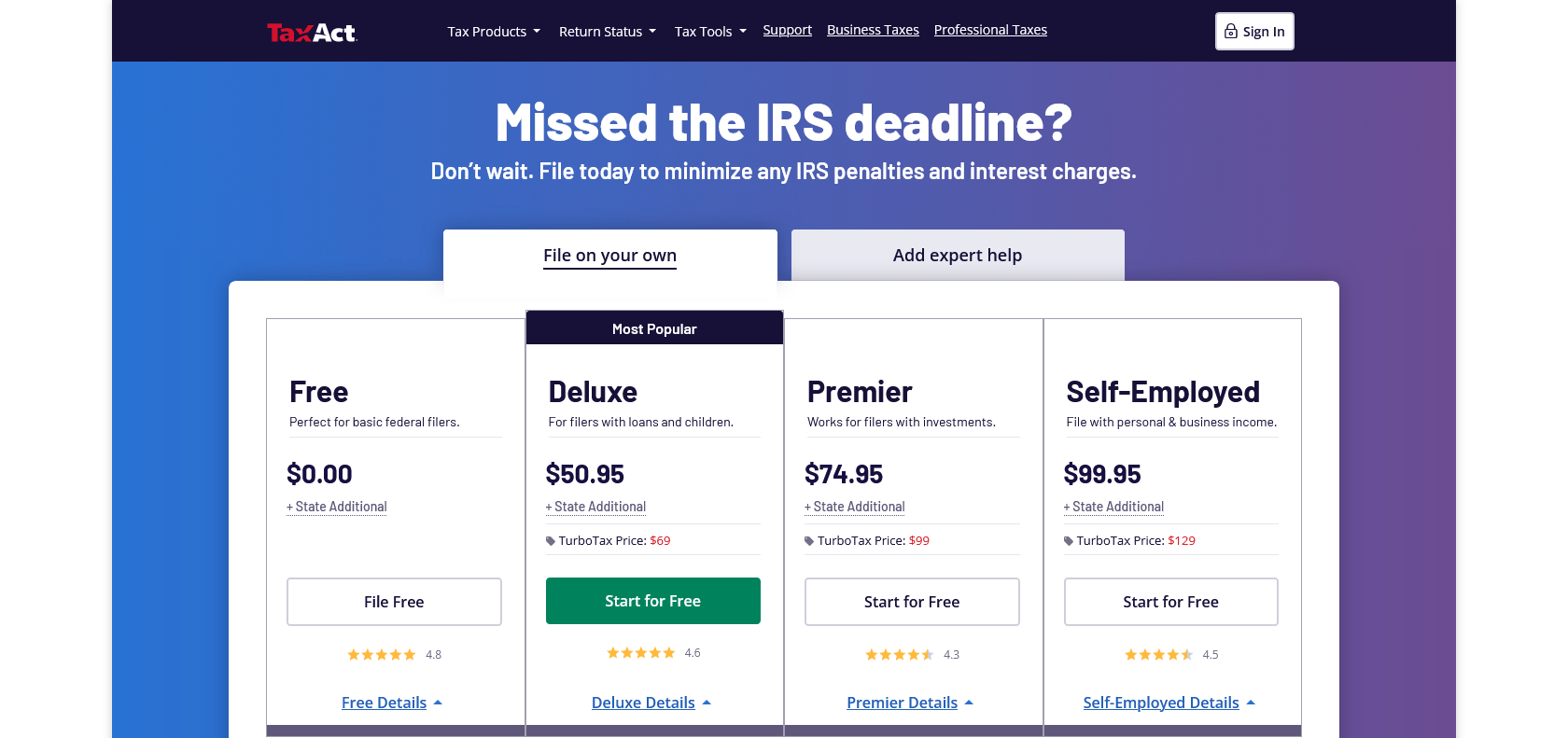

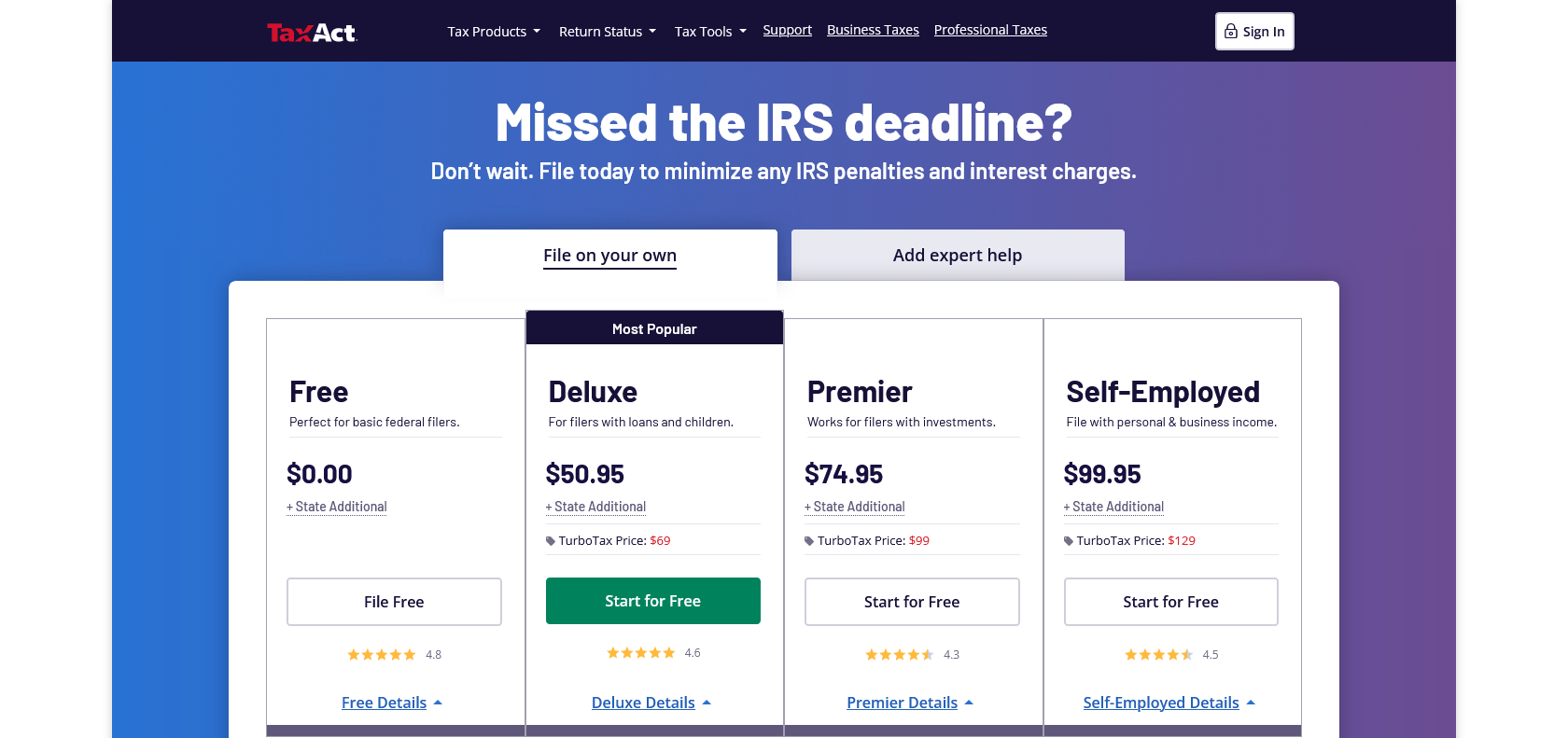

Maximize your tax return with TaxACT.

Get the most out of your tax return with TaxACT. Estimate your refund, maximize deductions, and file securely with their fast electronic filing.

TaxACT is a comprehensive and reliable tax preparation service that aims to simplify the process of filing your taxes. With its user-friendly interface, you can effortlessly and accurately complete your taxes. It is designed to maximize your tax return by providing features like a tax calculator, which gives you an estimate of your refund. Additionally, TaxACT ensures that you take advantage of all available deductions and credits to optimize your outcome. Should you have any queries, expert advice is readily available to address your concerns. Taking advantage of TaxACT's fast and secure electronic filing guarantees a quick and worry-free tax submission process. Furthermore, their dedicated customer service team is always ready to provide assistance whenever you need it. Trust TaxACT to deliver top-notch service and simplify your tax filing experience. Start using TaxACT today and enjoy a stress-free tax season.

Access expert advice from TaxACT's support team.

TaxACT

Join the AI revolution and explore the world of artificial intelligence. Stay connected with us.

Copyright © 2025 AI-ARCHIVE

Today Listed Tools 345

Discover 7422 Tools